Global Talent Trends – December 2025: Marketing and IT Roles Surge Over 35% YoY as AI-Human Coexistence Becomes a Strategic Career Imperative

Human Global Talent Co., Ltd., operator of Japan’s leading bilingual career site Daijob.com, has released the Daijob.com Jobseeker Trends Report for December 2025, highlighting the latest movements in the global talent market.

As the year-end business cycle in Japan reaches its peak, this report provides key insights into how the market is shifting—offering critical data for both employers and jobseekers navigating the current landscape.

For reference, the November 2025 edition is available here:

About the Global Talent Data

In this report, “global talent” refers to individuals registered on Daijob.com who possess business-level proficiency or higher in both English and Japanese. The analysis focuses on users who were active during the reporting period—specifically, those who either submitted a job application or showed interest in scout emails.

Key Highlights

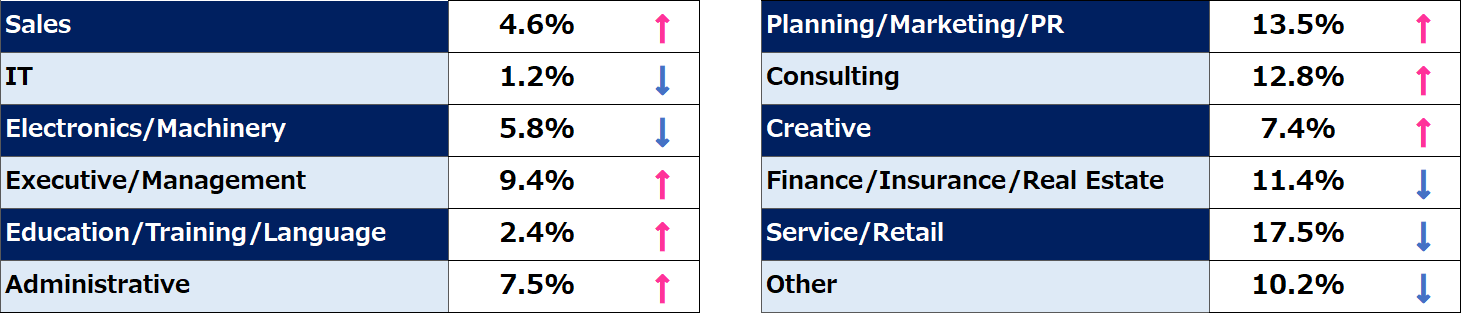

Double-digit Month-over-Month growth in Marketing/PR (+13.5%) and Consulting (+12.8%), signaling strong year-end momentum in specialized sectors.

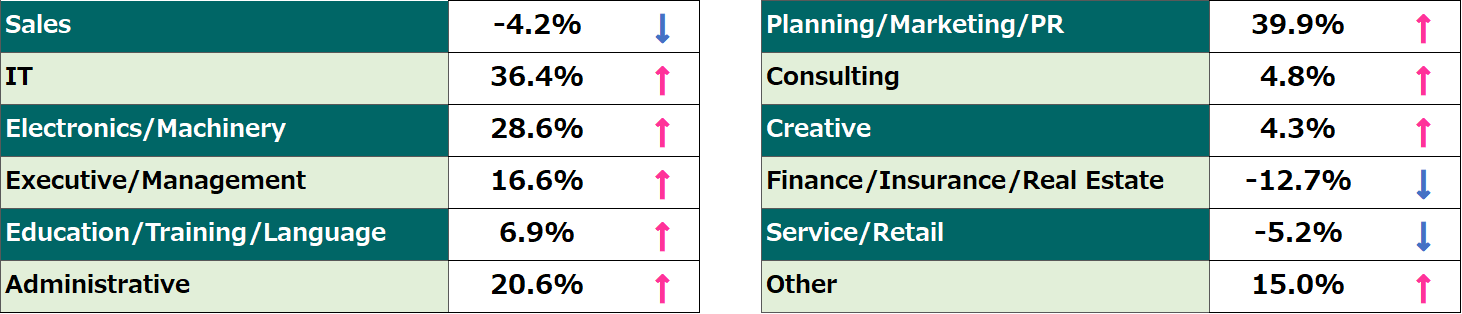

Significant Year-over-Year expansion led by Marketing/PR (+39.9%) and IT-related roles (+36.4%), as demand for high-value bilingual talent continues to outpace the broader market.

Month-over-Month Comparison: Specialized Roles and Executive Classes Maintain Momentum Ahead of the New Year

Comparing December 2025 with the previous month (November 2025), we observed a notable divergence in jobseeker activity. Highly specialized sectors led the market, with Marketing/PR rising 13.5% and Consulting advancing 12.8% MoM. Furthermore, the Executive/Management category posted a 9.4% uptick, indicating that high-caliber talent is proactively positioning itself for new leadership mandates in the upcoming calendar year.

In contrast, sectors such as Service/Retail (-17.5%) and Finance/Insurance/Real Estate (-11.4%) experienced a broad-based contraction. This decline is attributed to a combination of year-end peak-season operational demands and a "strategic waiting period," during which candidates monitor market conditions following winter bonus disbursements.

Jobseeker Trends Comparison – Month-over-Month, December 2025

Year-over-Year Comparison: Structural Growth in Marketing and IT Sustains High Market Liquidity

A Year-over-Year analysis reveals that despite short-term seasonal fluctuations, the long-term upward trajectory of the global talent market remains robust. Market liquidity has increased significantly across the board compared to the previous year.

Marketing/PR roles recorded an exceptional 39.9% increase YoY, while IT-related roles surged by 36.4%, reinforcing their status as the pivotal drivers of talent demand. Solid gains were also observed in Electronics/Machinery (+28.6%) and Administrative roles (+20.6%). Despite broader economic headwinds, aggressive corporate investment in Digital Transformation (DX) and global expansion continues to stimulate high levels of candidate movement and confidence.

Jobseeker Trends Comparison – Year-over-Year, December 2025

Analysis: Structural Shifts and the Evolution of the AI-Integrated Workforce

1. The Pivot Toward "Real Wage" Optimization Post-Bonus

December remains the most significant month for winter bonus disbursements in Japan. However, in the current inflationary environment, the focus for bilingual professionals has shifted from nominal compensation to real wage growth (purchasing power). Global talent is increasingly leveraging "language arbitrage"—executing strategic moves toward foreign-capital firms or export-oriented Japanese multinationals that offer a hedge against currency-driven wealth erosion.

2. "Job Augmentation" vs. "Value Rediscovery" via Generative AI

The surge in Marketing and Consulting activity indicates that Generative AI is not displacing high-value roles, but rather augmenting them. We are witnessing a "Value Rediscovery" phase: as routine data processing becomes automated, human capital is being redirected toward high-level strategy, creative brand equity, and complex problem-solving. Candidates are now strategically positioning their "AI fluency" as a premium differentiator to secure top-tier roles.

3. Addressing the "2025 Cliff": Scarcity in Technical Orchestration

As the deadline for the "2025 Cliff"—a critical juncture for legacy system modernization identified by the Ministry of Economy, Trade and Industry (METI)—increasingly impacts project delivery timelines, corporate urgency is reaching a fever pitch. The robust growth in IT-Related (+36.4% YoY) and Electronics & Machinery (+28.6% YoY) reflects a direct correlation between this systemic pressure and candidate activity.

A critical bottleneck has emerged for professionals capable of technical orchestration. As Japanese firms prioritize the overhaul of legacy infrastructure, there is a profound talent scarcity for bilingual specialists who can bridge the gap between domestic requirements and global solutions—specifically in managing offshore development and implementing international SaaS platforms. The significant surge in jobseeker activity suggests that these specialized engineers are moving with high conviction, fully aware of their heightened leverage in this "talent-short" environment.

4. Sectoral Migration: Reallocating Bilingual Capital to High-Productivity Functions

We define the month-over-month contractions in Service/Retail (-17.5%) and Finance/Insurance/Real Estate (-11.4%) not as a decline in engagement, but as a sign of market maturation.

There is an accelerating trend of "Intellectual Labor Migration," where bilingual professionals are leveraging the versatility of their hospitality and communication skill sets to transition into more high-productivity, value-added roles such as Administration (+20.6% YoY) and Marketing. This "self-directed shift" suggests that global talent is proactively addressing Japan’s broader productivity imperatives by reallocating their human capital toward more efficient sectors. Far from a loss of momentum, these figures represent a strategic evolution of the workforce as it migrates toward higher tiers of the corporate hierarchy.

5. Executive Leadership: Strategic Realignment for the 2026 Fiscal Cycle

The uptick in Executive/Management activity—rising 9.4% MoM and 16.6% YoY—signals that the "Organizational Transformation" cycle for the 2026 fiscal year is already in motion. As many organizations enter their Q4 planning phase (January–March) to finalize upcoming business strategies, there is an intensifying pursuit of leaders capable of operationalizing Generative AI within corporate structures.

For executive-level candidates, the ability to demonstrate a proven track record of AI-driven organizational change has become a pivotal career benchmark. This shift represents a critical juncture in market valuation; leaders who can successfully bridge the gap between technological innovation and traditional business models are positioning themselves as the most sought-after assets for the 2026 fiscal year.

Outlook — Sustained Activity with a Shift Toward Quality-Focused Hiring

The December 2024 data reveals more than mere seasonal fluctuation; it captures the early signals of a structural "Great Migration" across the global talent landscape. Following the foundational implementation of Generative AI in 2025, the market has reached a new equilibrium, shifting the focus toward a higher tier of candidate capability.

- Shift from prioritizing language proficiency to "AI-augmented business value."

To maintain a competitive edge in 2026, organizations must refine their acquisition criteria to attract elite talent who can maximize output through AI integration. - Enhance job postings with a clear commitment to operational autonomy and workplace flexibility.

These factors have become critical differentiators for high-value "skill-stackers" currently evaluating their next career move. - Maintain consistent engagement with potential candidates throughout the new-year selection cycle.

Leveraging the current momentum in the Executive and Marketing tiers will be vital for ensuring a smooth transition into the 2026 fiscal year.

Coming Up: Japan’s Largest Career Fair for Global Talent – March 6, 2026 (Fri)

The next Daijob Career Fair, Japan’s premier recruitment event dedicated to global professionals, is scheduled for Friday, March 6, 2026.

Participating organizations consistently report exceptional outcomes, with over 90% of exhibitors meeting high-potential candidates with strong hiring prospects. The upcoming fair will feature specialized zones for "Foreign-Capital Companies" and "Global Opportunity Firms," providing a high-impact platform to engage directly with Japan's most mobile and skilled bilingual talent.

If your organization is looking to accelerate its talent acquisition strategy, we encourage you to contact us for further participation details.