Global Talent Trends – November 2025: Market Enters Year-End Strategic Waiting Period as Electronics & Machinery Posts the Only Month-Over-Month Growth

Human Global Talent Co., Ltd., operator of Japan’s leading bilingual career site Daijob.com, has released the Daijob.com Jobseeker Trends Report for November 2025, highlighting the latest movements in the global talent market.

As the autumn hiring season in Japan reaches its peak, this report provides key insights into how the market is shifting — valuable data for both employers and jobseekers alike.

For reference, the October 2025 edition is available here:

About the Global Talent Data

In this report, “global talent” refers to individuals registered on Daijob.com who possess business-level proficiency or higher in both English and Japanese. The analysis focuses on users who were active during the reporting period—specifically, those who either submitted a job application or showed interest in scout emails.

Key Highlights

Sharp month-over-month declines across IT, Sales, and Finance as the market enters a clear year-end “strategic waiting period”

Strong year-over-year growth led by IT (+32.5%), with notable gains in Sales and Service-related roles

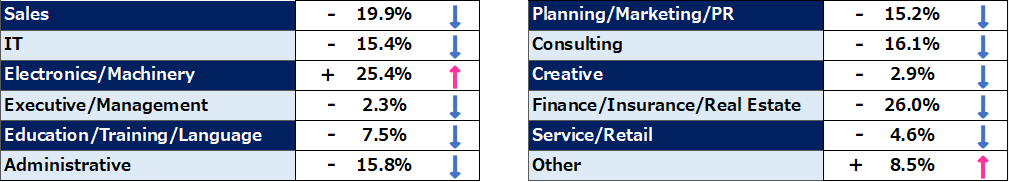

Month-over-Month Comparison: IT, Sales, and Finance See Significant Declines as the Year-End “Strategic Waiting Period” Begins

Comparing November 2025 with the previous month (October 2025), jobseeker activity decreased across nearly all major job categories. This shift strongly indicates that the market has entered the year-end strategic waiting period, a seasonal phase in which many candidates temporarily pause their job search.

Finance/Insurance/Real Estate declined by 26.0%, Sales by 19.9%, Consulting by 16.1%, and Administrative roles by 15.8%, reflecting broad-based contraction. IT-related positions also fell by 15.4%, marking a full cooldown following the sharp surge seen in September.

The one notable exception was Electronics & Machinery, which rose 25.4% month-over-month, making it the only category to record meaningful growth during this period.

Jobseeker Trends Comparison – Month-over-Month, November 2025

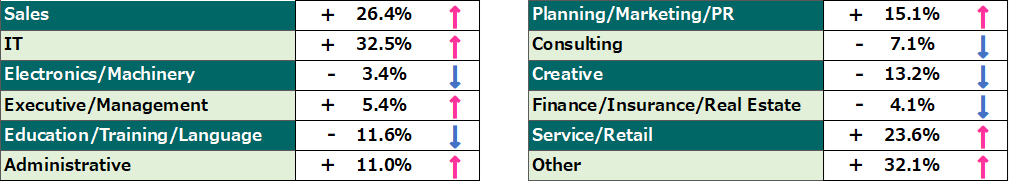

Year-over-Year Comparison: IT-Related Roles Surge 32.5%, with Strong Gains in Sales and Service-Related Fields

Comparing November 2025 with the same month in 2024, the data shows that despite this month’s short-term slowdown, the long-term growth trend remains firmly intact.

IT-related roles increased by 32.5% year-over-year, the highest growth among all job categories, underscoring their continued appeal for global talent.

Sales positions rose by 26.4%, Service & Retail by 23.6%, and Marketing/PR by 15.1%, reflecting strong momentum in customer-facing and business expansion–driven functions.

In contrast, Electronics & Machinery (-3.4%), Education/Training/Language (-11.6%), and Creative roles (-13.2%) saw year-over-year declines.

Jobseeker Trends Comparison – Year-over-Year, November 2025

Analysis: The Market Enters a Year-End “Recharge Period,” Shifting Hiring Strategy Toward the New Year

1. Seasonal Dynamics and the Influence of Winter Bonuses

In Japan’s job market, November consistently reflects a dip in application activity as many candidates choose to wait until after receiving their winter bonus in December before initiating resignations or onboarding processes. This tendency is particularly evident among higher-earning professionals in IT, Sales, and Finance.

As a result, the surge in IT-related applications observed in September has eased. Activity has transitioned from rapid job-switching behavior to more deliberate matching and screening, suggesting a healthier, more selective job market dynamic.

2. What Explains the Outlier Growth in Electronics & Machinery

Electronics & Machinery, which increased 25.4% month-over-month, stands out as the only category to gain momentum during this period. Several factors may be contributing to this movement:

- Heightened urgency for specialized hires:

Some companies face deadlines tied to year-end project delivery or new technology development, prompting highly targeted recruiting efforts in November that translate into actual applications. - Inflow of hybrid IT–engineering talent:

As digital transformation continues within the manufacturing sector, demand for professionals with both IT and mechanical expertise remains strong—resulting in fewer candidates opting to postpone their job search.

3. Long-Term Momentum Remains Strong for IT and Business-Driving Roles

Although IT and Sales-related positions declined month-over-month, year-over-year comparisons show robust growth of over 25% across both categories. This indicates that demand for global talent continues to hold at historically elevated levels.

- IT-related roles (+32.5%):

Ongoing investment in AI, cloud infrastructure, and cybersecurity continues to underpin long-term expansion. - Sales and Service-related roles (around +25%):

The recovery of inbound demand and continued corporate investment in overseas markets are sustaining strong appetite for bilingual frontline talent.

4. Outlook — Sustained Activity with a Shift Toward Quality-Focused Hiring

While November represents a period in which many candidates temporarily “wait,” it also serves as an important preparatory phase for employers ahead of the substantial market reactivation expected in January and February.

- Shift from prioritizing application volume to strengthening the candidate pipeline.

- Maintain consistent engagement with potential candidates throughout December to ensure a smooth transition into the new-year selection cycle.

- Enhance job postings with clearer articulation of future business direction and role differentiation to capture the attention of jobseekers currently in consideration mode.

Coming Up: Japan’s Largest Career Fair for Global Talent – March 6, 2026 (Fri)

The next Daijob Career Fair, Japan’s largest job fair dedicated to global professionals, will take place on Friday, March 6, 2026.

Over 90% of participating companies consistently report meeting high-potential candidates with strong hiring prospects at this event. The fair offers a rare opportunity to engage directly with bilingual, globally minded job seekers.

If your company is considering participation, we encourage you to contact us for more information.